FREE WHITEPAPER

Claim Up To $5.00/sq.ft.

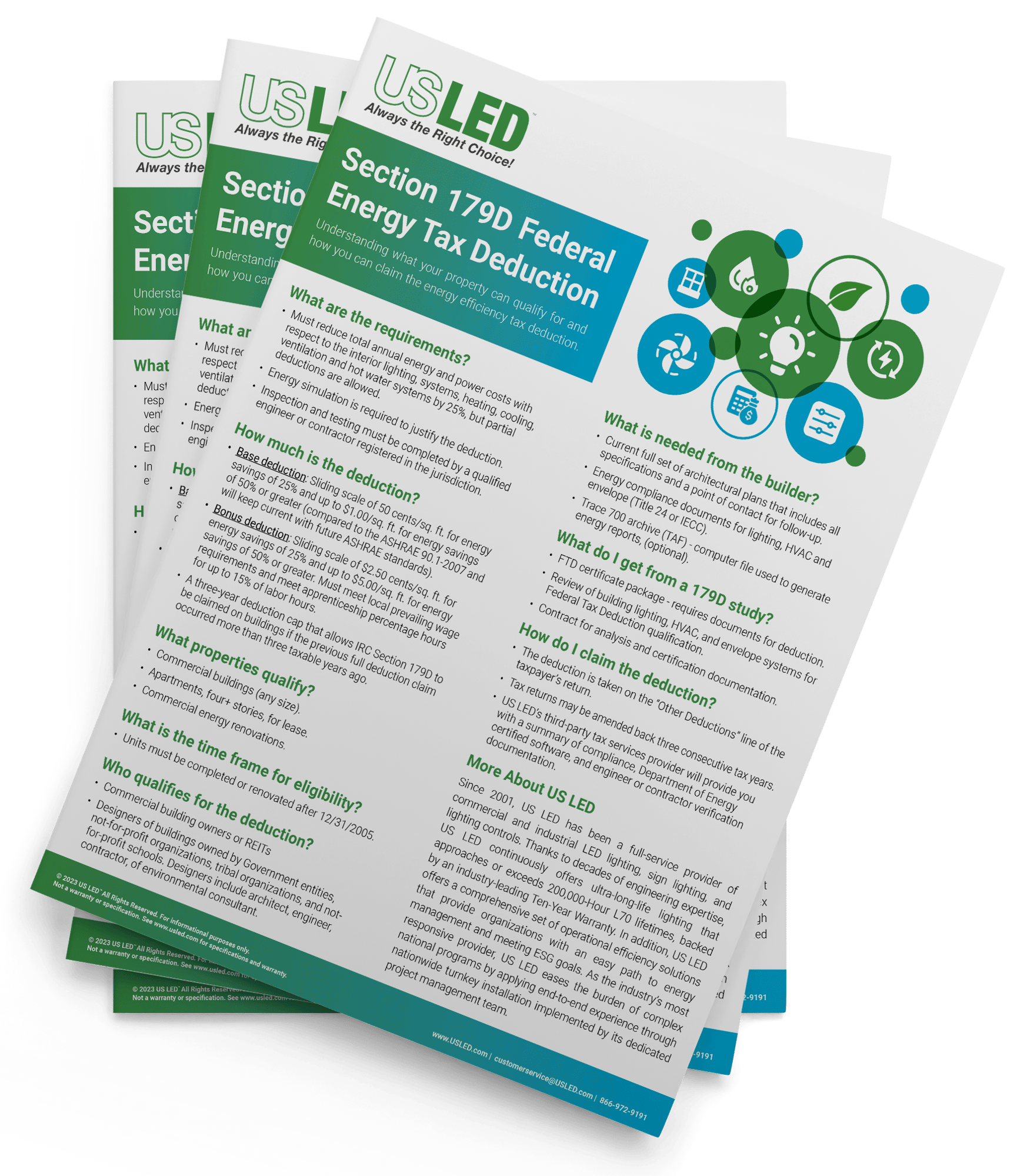

With the 179D Commercial Buildings Energy-Efficiency Tax Deduction, qualifying property owners can claim up to $5.00 per square foot for installing qualifying building systems associated with energy-efficiency improvements, including new interior lighting and HVAC systems.

Download The 179D Tax Deduction Whitepaper

Answers a few questions and your free whitepaper will be sent to your email.

How Does The 179D Deduction Work?

Property owners could cover a significant portion (or all) of the implementation costs of LED lighting and HVAC systems. With this free whitepaper, you'll get the following questions answered:

|

Who is eligible and which type of properties qualify for the deduction? |

|

What is the base tax deduction amount, and how do you qualify for the bonus deduction of $5.00/sq. ft.? |

|

What's the process of claiming the 179D and how does US LED provide a complimentary analysis done? |

“We were pleasantly surprised at the substantial tax savings we could capture. Partnering with US LED, we could reap the benefits of 179D and almost completely cover the cost of our efficiency improvements.”

Chief Engineer of Asset Services | National Real Estate Firm | Houston, Texas

179D Tax Deduction Frequently Asked Questions

|

We have multiple properties in our portfolio. If I want to complete multiple projects nationally, does that multiply my deduction? The 179D tax deduction is based on square footage and documentation showing the improvements performed for each project. US LED eases complex national rollouts by applying end-to-end experience through turnkey installation and project management teams. Talk to one of our experts as soon as possible to learn how we can give you a complete 179D benefit overview, include utility rebates, and how to maximize your operational efficiency strategy. |

|

Does The 179D tax deduction apply to new construction and retrofits? Yes! To qualify, newly constructed or retrofitted buildings must have system improvements that reduce energy, such as interior lighting (not exterior), building envelope (roof/windows), HVAC, and hot water systems. Efficient systems must reduce energy costs by 50% or more compared to the ASHRAE 90.1-2007 requirements. |

|

Can real estate investment trusts (REITs) apply for the 179D tax deduction? Yes, real estate investment trusts can apply for 179D deductions against earnings and profits. |

|

Over what period is the 179D tax deduction available? A three-year cap that allows the Section 179D tax deduction to be claimed on buildings if the previous full deduction claim occurred more than three taxable years ago. Find even more questions in the whitepaper! |